It’s a concept as old as America. We waged a war of independence over this one issue. If I can’t vote, I shouldn’t be taxed.

The tourist tax, first enacted for Horry County by the S.C. General Assembly in 2009, threw this concept entirely overboard, however. The general thinking was: “Let’s tax the tourists. They can’t vote.”

The tourist tax extension was a law submitted last year by Horry County local delegation, (H*5011 (Rat #0208, Act #0249 of 2016) General Bill),

By Clemmons, Fry, Johnson, Duckworth, Hardee, Anderson, Goldfinch, George, Hayes, H.A. Crawford and Ryhal

Mr. Ryhal has since stepped down. Speculation is that he will replace local S.C. lobbyist Mark Kelly. Tim McGinnis was recently elected to his office.

The exact language of the law is bulky, as most legal language can be. Section (B)(1) below states that the extension of this law can be done by city-wide voter referendum or adopted by a super-majority of five yes votes from the combined six elected Myrtle Beach city council members, plus the mayor.

When they wrote the law, the S.C. General Assembly inserted no true transparency and little accountability into it. While the provisions below practically limit the agency who can manage the funds to either the Myrtle Beach Area Chamber of Commerce or the North Myrtle Beach Chamber, no public annual audit requirement is anywhere in the bill.

We asked current city councilmen Wayne Gray and Randal Wallace, both of whom’s term expires in January:

Do you believe the TDF (tourist tax) should be put out before a public referendum with a mandatory annual public audit of the tax dollars spent by MBACC required?

We have not heard back from either, as of this date, however, sources close to Mayor John Rhodes say he might be interested in putting the vote before a city-wide voter referendum.

Says Myrtle Beach city resident, Karon Mitchell, “There’s really no need to put the tourist tax before city voters if no mandatory independent, public audit is not also required along with the referendum. Who gives $24 million in tax monies to an organization and then doesn’t require a public annual audit?”

Said Ed Carey, who ran for Mayor in this cycle, “The TDF as currently administered has very questionable accountability of how the public tax funds are spent. In addition there is also a lack of transparency as to a competitive (if any) procurement process of the expenditures of these public tax dollars. So to ask whether a public referendum will answer the appropriateness of the program, I feel it is premature to ask. I would also be wary of the way any referendum question is phrased.”

As MyrtleBeachSC.com reads the law below, there is no stipulation limiting Myrtle Beach city council from adding a required independent, public audit locally before the funds are given to the MBACC.

We put the idea before Myrtle Beach locals. With the exception of the bottom comment, they all 100% agreed. Each said the tourist tax with an audit requirement should be put before the voters by referendum.

While the law was intentionally written to ensure the funds could only go to limited organizations, residents have asked questions as to whether MBACC has been competent in how they used the funds.

Residents say that MBACC is stuck in an outdated, ineffective mindset of buying push message ads on TV and print.

Residents believe MBACC should place a greater focus on engaging tourists online. Brand development, brand engagement, and brand relationships are now paramount in marketing a destination. Simplistic approaches like buying ads on “out of market” TV stations and print magazines are no longer effective, locals told MyrtleBeachSC.com.

Those running for office this Fall all agreed that the Myrtle Beach brand also needs to be improved, with a focus on public safety.

Two Cities – Two Different Outcomes

Both Las Vegas and Myrtle Beach each experienced high profile shootings in 2017.

Both drew national headlines. Media savvy Las Vegas welcomed the nation in for a time of mourning. Their business actually went up.

Myrtle Beach attempted to minimize the shootings, denied we have a crime issue, and over responded. The city administrator chose to put barricades on Ocean Boulevard. July 2017 business plummeted as a result. The event, and the issues surrounding the event, remain unresolved in the minds of tourists.

PROBLEMS WITH THE LAW AS WRITTEN IN 2009 BY THE SC GENERAL ASSEMBLY

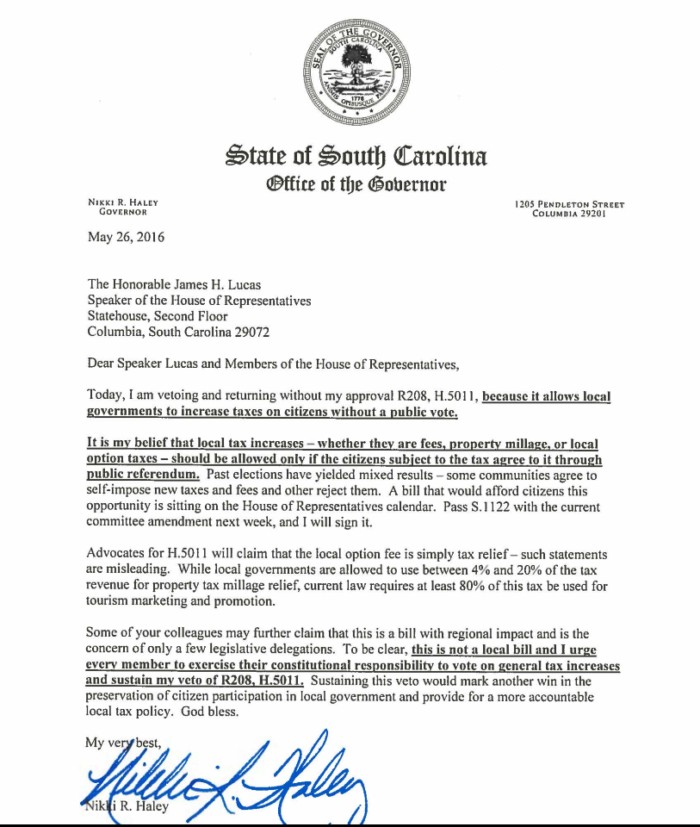

Below is the exact language of the law and the reasons, then Governor Nikki Haley, chose to veto the law. The veto was over-ridden by the General Assembly Summer 2016.

Section 4-10-930. (A) Subject to the requirements of this article, a municipality may impose in the municipality a fee not to exceed one percent for not more than ten years for the purposes provided in Section 4-10-970 by:

(1) an ordinance adopted by a supermajority of the municipal council which must be at least two-thirds of the members of a municipal council; or

(2) the approval of a majority of qualified electors voting in a referendum held pursuant to this section called by a majority of the members of the municipal council.

(B)(1) Upon the adoption of a resolution calling for a referendum by the municipal council, the municipal election commission in each municipality shall conduct a referendum on the first Tuesday ninety days after of the adoption of the resolution on the question of implementing the fee within the municipality. The state election laws apply to the referendum, mutatis mutandis. The municipal election commission shall publish the results of the referendum and certify them to the municipal council. The fee must not be imposed in the municipality, unless a majority of the qualified electors voting in the referendum approve the question.

(2) The ballot must read substantially as follows:

‘Must a one percent fee on the gross proceeds of sales or sales price of all amounts subject to the sales and use tax imposed pursuant to Chapter 36, Title 12, but not the gross proceeds of the sale of items subject to a maximum tax in Chapter 36, Title 12 and the gross proceeds of sales of unprepared food that lawfully may be purchased with United States Department of Agriculture food coupons, be levied in __________ for the purpose of tourism advertisement and promotion directed at non-South Carolina residents?’

(1) its promotional and advertising programs are based on research based outcomes;

(2) the organization has a proven record of success in creating new and repeat visitation to the county;

(3) it has sufficient resources to create, plan, implement, and measure the marketing program generated by the fee revenues;

(4) it will use the funds only for the purposes provided pursuant to subsection (B)(1) of this section.

(C) Municipalities located in the same county that are imposing a fee pursuant to this article may jointly designate a regional tourism promoter located in the county to jointly promote tourism in the municipalities imposing the fee. The regional tourism promoter must be designated in the manner provided in subsection (B) and may only promote tourism to non-South Carolina residents.”