An email sent out by Mark Kruea of the City of Myrtle Beach last night informed local residents that Myrtle Beach City Council will do the final reading for approval on what is called the Tourist Tax (TDF) on Tuesday.

Prior to the vote, an independent auditor will make a presentation on behalf of MBACC in response to a lawsuit filed by local Myrtle Beach city residents. Residents we spoke with do expect Mayor Bethune and Myrtle Beach City Council to approve the TDF law unanimously. This measure will be passed on behalf of the Tourism Lobby, circumventing a local voter referendum.

The Myrtle Beach Area Chamber of Commerce continually touts the jobs created by this tax. In peak season, it is estimated that as many as 4,500 maids work in Myrtle Beach from the months of May through September.

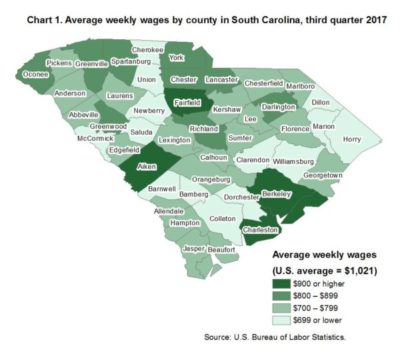

U.S. Bureau labor statistics show Horry County workers are among the lowest paid workers in the state taking home an average of $699 per week.

Should a group of four maids wish to have someone rush out to the local Sub shop to pick up a quick bite for the group,

purchasing the Pizza Sub, which is the least expensive item on the menu,

the total price of the purchase with a drink would come to $28 for the group. The TDF (tourist tax) charged to these maids would come to 28 cents.

When you multiply this by 4,500 maids working for 150 days, however, the total taxes collected from these maids comes to $50,625.00 annually. Those taxes apply if the maids only make one fast food purchase in the city and only work four months of the year.

This when they purchase the most inexpensive fast food at the lowest prices in Myrtle Beach.

Compare these wages to the wages paid by MBACC in TDF funds to its own staff created “questionable” companies.