On September 29, 2020, Myrtle Beach City Spokesperson told WMBFNews, the city would be laying off a minimum of 45 city employees due to Covid 19 required budget cuts.

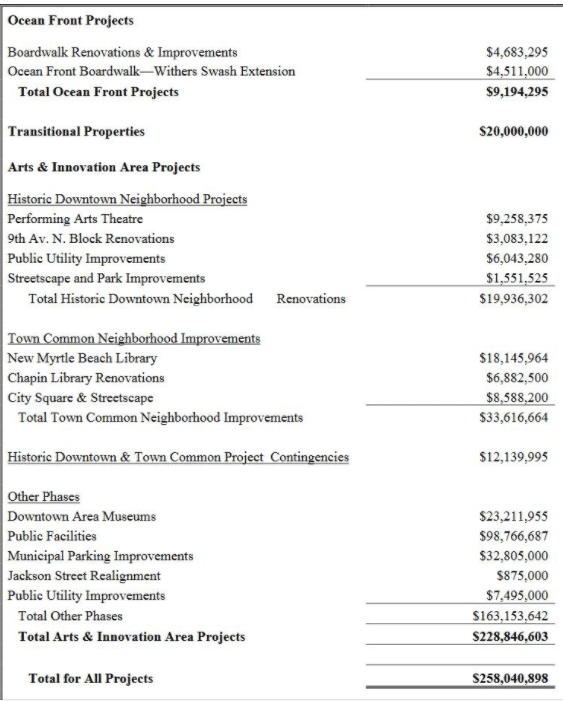

This week the City of Myrtle Beach planned a first reading vote to add $258 million to the city’s debt burden for the sake of museums, downtown public facilities, purchasing privately owned properties, and more.

“Obviously, the new budget year began July 1 with a much tighter (and smaller) budget than for the last fiscal year. Just as businesses were affected by the COVID-19 economy, so were governments,” Kruea said in September.

Kruea said the city’s current fiscal year budget is $193.7 million, which is much lower compared to the previous year’s fiscal budget.

“That budget is much smaller and tighter,” Kruea said. “It’s $7.8 million less already and yet we still found the need to cut additional monies out of this current spending year. We have more than 900 city staff members. That’s our biggest expense and that’s also the most likely place where we can find some savings. So we looked at what the private sector does. A voluntary retirement program, so that we could help people achieve their retirement goals while helping the city save some money.”

GOVERNMENT BUYING UP PRIVATE PROPERTY

“Transitional Properties $20 million” in the chart below refers to a loan pool the city wants to use to buy up existing private property.

The former Downtown Redevelopment Corporation had a similar loan pool before it was disbanded. Several ongoing lawsuits against the City of Myrtle Beach are currently in progress as former merchants complain the city has the power to force businesses into selling the city land the city wants to buy.

It’s a question of morals. Should a city that has the ability to use zoning, policing, and business licensing power also be allowed to use a loan pool for purchasing private property from owners who do not wish to sell?

The current SuperBlock lawsuits are classic examples of government overreach gone wrong.

PROPOSED DEBT PURPOSES

QUESTIONS ASKED TO MYRTLEBEACHSC NEWS

- When a TIF is set up, funds can only be used for infrastructure within the TIF area so this means the taxes in the TIF fund cannot go toward general city expenses like police and fire.

- With 3 council members and the Mayor up for election next November, a new City Manager, and a new CFO (since the City Mgr and CFO are retiring), wouldn’t it be better to wait to expand this TIF?

- The $20,000,000 for Transitional Properties would be like the loan pool the DRC used to buy up private properties the city wanted. Are they planning on forcing more businesses out?

- City owned property will not generate property taxes.

- With the previous, high profile harassment of existing business owners, who will risk investing downtown? Other than those few selected for free and no upfront money opportunities (Coastal Carolina University – for example), no one is currently investing.

- Current debt is about $6,000 per person at $208+- million so if the entire $258 million proposed is borrowed, the city will be more than doubling our debt while North Myrtle, that uses more of a pay as you go modus operandi, only owes about $5 million.

- North Myrtle owes $5.1 million. Myrtle Beach owes $208 million. The interest we have to pay, $8 million next year, exceeds the entire debt of North Myrtle.

- The boardwalk needs serious work, proposed here at $4,683,295, but it is not paid for yet because the city tends to borrow for a number of years, and they also refinance at times instead of paying off loans quickly.

- The city is already proceeding with the “Historic Downtown Neighborhood Projects” list of $19,936,302.

- Why buy and renovate a theater for CCU to use FREE for 5 years. Shouldn’t CCU fund this?

- Why fund another money losing museum? This one would not even be operated by the city.

- What are the “Public Facilities” for the tune of $99 million?

- What is planned that we are not being told about? Is this laying the foundation for a major B&C project? That would be great, but not at taxpayer expense.

- Normally one would think this type visioning would wait for the annually scheduled budgeting process.

- I don’t see outfall projects to improve water quality on the list of what makes up the proposed $258,040,898 expenditures.

These new debt increases leave residents with many questions.

Sadly, the city has not been overly forthcoming with any details of how it plans, leads, organizes and coordinates these concerns.