If you are starting a small business, you will need to develop a comprehensive strategy to guide your business growth. While running a small business can be an exciting way to build something from the ground up, it can also be an uphill challenge. Therefore, you want to be sure that you employ the right methodology to give yourself the best possible chance of success.

This article will describe what a business growth strategy is and lay out steps for designing and executing one. We will discuss pitfalls to watch out for along the way and provide tips for how to maximize your growth potential.

What Is A Business Growth Strategy?

A business growth strategy is exactly what the name implies: a strategy that a business creates with distinct steps to enable the business to grow through different stages. Your business growth strategy should guide you through all the necessary steps, from determining your potential place in the market all the way through implementation.

Regardless of your particular goals, your business growth strategy should involve the creation of a distinct business development plan. This will be the foundation of your growth strategy. In creating your business development plan, you will need to figure out exactly what products or services your business will include, who your target audience will be, etc. We will describe this further below.

Steps to Create A Business Growth Strategy

There are a distinct series of steps you should take in developing your business growth strategy, which we will lay out here.

Estimate Your Current Position

In order to determine how feasible a business plan you have, you will have to figure out what your current position is and what you will need in order to get started. This means determining what you have and how much you will need to get off the ground.

Start by considering the following questions:

- How does your business idea align with your skills/experience?

- Are you interested in selling products, services, or both?

- Do you have any existing funding?

- How much time are you willing to invest in your new business?

- How quickly do you want to scale your business?

- Would you consider opening a franchise instead?

Conduct Market Research and Analysis

Before you get started with your plan, you will need to conduct market research in your business area. This will involve gathering data about who the major players on the market are and what direction industry trends are going in.

You should determine who your target audience will be and what the defining characteristics of this group are. You should then conduct primary research with members of this group in the form of interviews or surveys to determine how feasible your business ideas are with them. Combine this primary research with secondary research (industry reports, statistics) to better assess where you stand.

Financial Planning and Implementation

Once you have determined how feasible your plan is and gotten an idea of your place in the market, you should start financial planning. You can secure the necessary funds to get your business off the ground with an online business line of credit.

When you prepare your financial plan, you should consider the following three primary elements:

- A cash flow statement. This is a financial statement that breaks down operating, investing, and financing activities and summarizes cash and cash equivalents leaving a company.

- An income statement. Your income statement (also known as a profit and loss statement) is what indicates the amount of profit and loss you have over a given period. This includes the following components:

- Operating expenses

- The cost of goods

- Revenue streams

- Your net profit or loss

- A balance sheet. Your balance sheet is what allows you to see where you stand at any given moment. This includes your assets, liability, and shareholder equity.

Risk Management

Another important element of your small business planning will be establishing risk management mechanisms. There are a variety of risks that small businesses face, and if you are not prepared to handle them, the consequences could be devastating for you. You should do everything possible to ensure that you minimize potential risks before you get started.

The risk management process consists of several stages:

- Identifying what types of risks you have (property loss, liability claims, employee injuries)

- Assessing how vulnerable you are to each of these risks

- Designing strategies to mitigate risks and minimize the possibility of their occurring

- Buying insurance to protect yourself

You will also have to determine the type(s) of insurance that you will need, including general liability, professional liability, commercial property, etc.

Implementation and Measuring Plan

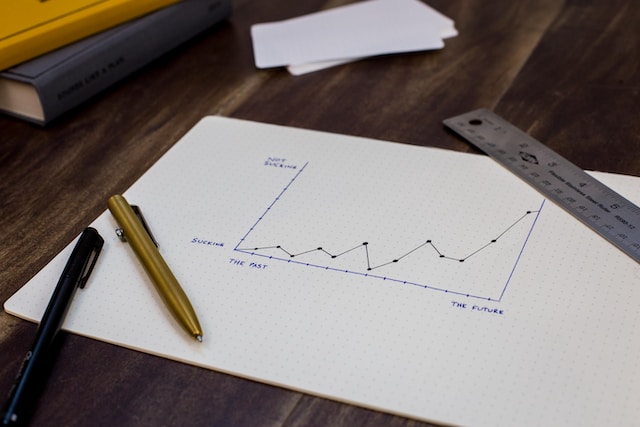

Finally, it will be time to put your plan into action when you formally start your business. Your implementation and measuring plan will lay out your strategic goals and provide guidelines on how to measure them.

The steps you should take in your implementation plan include the following:

- Define your goals clearly. For small businesses, it is recommended that you find high-impact growth opportunities to aim for.

- Conduct research on the goals that you want to achieve, and search for strategic partners to work with.

- Schedule milestones for yourself to give yourself specific short-term goals to reach for. These will also serve as a way for you to assess your progress later on.

- Assign responsibilities to your staff members

- Allocate resources accordingly

To measure your success in your implementation plan, you should include specific metrics for how to do so. These include:

- Your revenue and net profit

- Net growth within established periods

- Average monthly leads

- Lead conversion rates

You will likely have to adjust your implementation and measuring plan as you go along, but it will serve as a good structure for you to start.

Summing Up

In order to create a successful growth strategy for your small business, you need to go about the process systematically. Start by assessing your current situation, conducting research on the market, looking into sources of financing and creating a financial plan, determining your risk management solutions, and creating an implementation and measuring plan. If you do all of these things correctly, you should be in good shape to start your business.