With home prices soaring over the past few years, property taxes should have increased right alongside them. However, the housing market took off so quickly, property tax increases could hardly keep up. Now in 2023, it seems this small blessing of lower effective property taxes could turn into a nightmare for recent homebuyers. Will property taxes start ramping up to keep pace with rising home values?

In order to answer this question, the team at Today’s Homeowner analyzed housing data across 50 states and 585 cities from 2016 to 2021.

Here are some of the main findings:

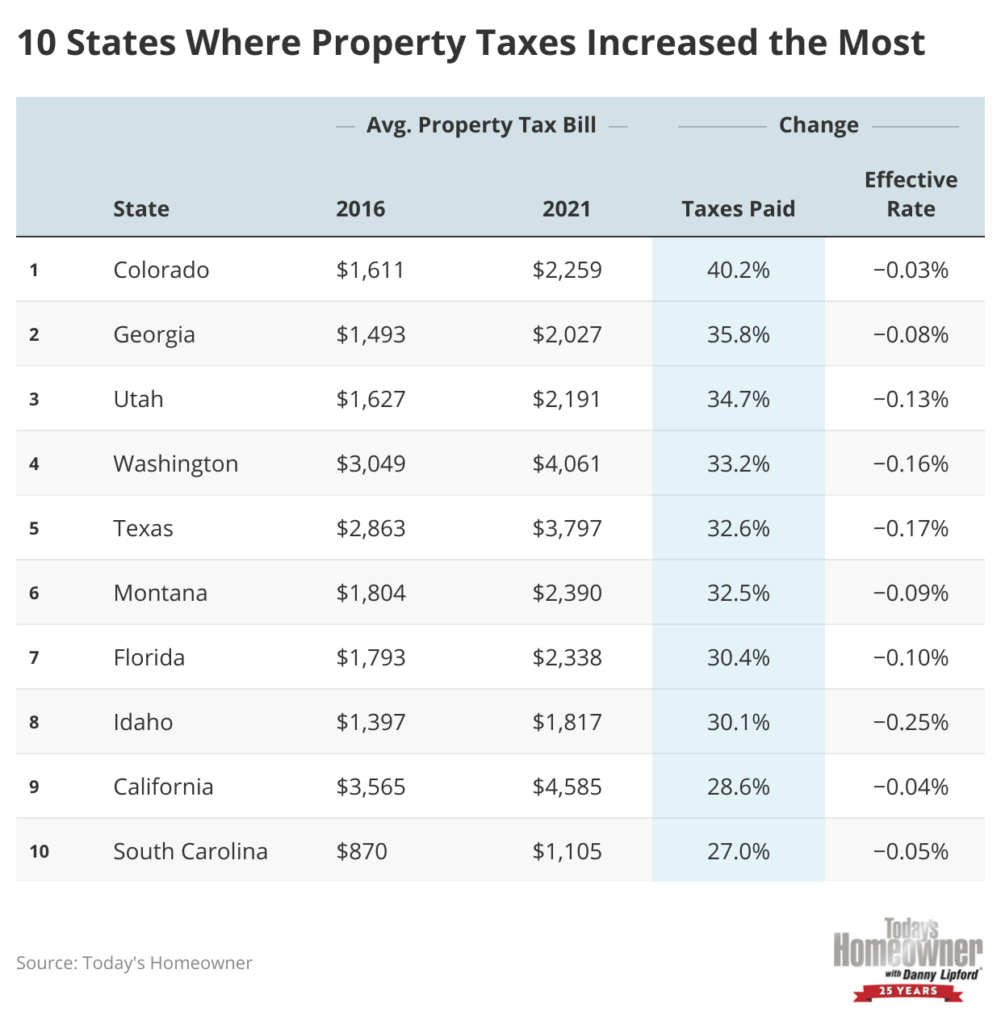

- South Carolina is the #10 state where residents are paying more on their property taxes.

- In 2016, South Carolinians were paying an average of $870 annually on their property taxes. In 2021, that number jumped to $1,105. A staggering 27.0% increase.

- While South Carolinians’ property tax bill increased, their effective property tax rate actually decreased by -0.05%.

- Nationally, the average property tax bill increased by more than 19% over the past five years ($2,340 to $2,795) while the average effective property tax rate dropped by 0.15% (1.14% to 0.99%).

- Average property tax bills rose the most in Western states, including Colorado (40.2%), Utah (34.7%), and Washington (33.2%).