Making investments is the best way to ensure that you have a bright future ahead of you. Sure, it’s expensive, and you may need this excess money for something else, but you’re making an investment now for a long-term value (kind of like buying an engagement ring). Now, when it comes to investing, the majority of people’s minds go straight to stocks, bonds, and real estate. What they don’t tell you is that these are just some of your options. There are so many other asset types that you should consider, and here are seven investment ideas to consider.

- Peer-to-peer lending

The world lies in the decentralization of finance. Therefore, people in need of a loan no longer have to go to a bank or a credit union. Instead, they can find a peer-to-peer lending platform and borrow from people like them.

Now, as someone with excess money you want to invest, you can always find a P2P platform and find yourself some borrowers. Now, the majority of these platforms do a decent job of profiling lenders. This means that you’ll get their risk assessed, and you choose who you want to lend the money to.

Another amazing idea about this is the fact that it gives you a steady cash flow. In a way, you get a passive stream of income, seeing as how their monthly credit payments will be deposited directly into your accounts.

This is also a great way to diversify your portfolio and do a nice thing while you’re at it. When you come to think of it, peer-to-peer lending may just revolutionize lending as we know it.

- Cryptocurrency

Another great potential investment is cryptocurrencies. With so many crypto millionaires out there, no one can deny the validity of this as an investment option. Has it exploded in the future? Yes! Will it happen again? Almost certainly! So, what’s stopping you?

Now, while the cryptocurrency market is volatile, you need to take into consideration that this is the youngest major asset type out there. After all, cryptocurrencies only existed since 2008, which means that the concept itself is barely older than 15.

There’s no denying that cryptocurrency can be a good investment; however, you need to understand what you’re getting into. New cryptocurrencies usually come with a higher risk, but you also have a higher chance of running a great profit.

The best part is that it’s so easy to invest. All you need to do is research a bit online and find the right exchange. Then, you deposit some funds and start buying. The entire process can be done in a minute unless you need to get a crypto wallet, then a bit longer.

- Commodities

Commodities are not a new asset type or a new investment idea, but there are a lot of investors who just skip them. Why? It’s not intuitive from their flawed perspective.

You see, according to the majority of investment guides, you need to keep 10-15% of your investment money in commodities. However, this isn’t the way to maximize profit, and there are a lot of people who believe that the best way to invest is to find the most profitable investment and put as much as they can toward it. What do they say about keeping all your eggs in one basket?

You see, commodities have a weak correlation with stocks, bonds, and even fiat currencies. When people start losing faith in institutions, they start trusting gold and silver. Why? Well, because these are the assets that they can stuff in their bag and travel with.

You can buy precious metals, agricultural products, and virtually anything else that you can find online (or even locally).

- Intellectual property

Intellectual property is usually very cheap when discovered early, and it can turn into a lucrative passive income later on. For instance, by owning a popular piece of art, you can live off royalties for years to come.

One of the things that Kickstarter was good for was discovering various interesting patents. Sure, the majority of them were completely useless, but if something looked handy, you could always reach out to the creator and see if you could buy it off their hands. If the fundraising or crowdfunding isn’t doing too well, you could even get it at a bargain price.

Copyrights to works of art, logos, and slogans are incredibly cost-effective in this day and age. You buy once, and you get to profit from every single piece of merchandise that has it printed on them. Sure, the majority of people create them, but you could also commission something like this if you have an amazing idea.

The same goes for getting a team to develop software and owning a license.

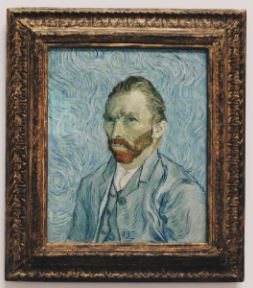

- Art

Investing in art can be cost-effective, even if we’re not talking about paintings and sculptures worth hundreds of millions of dollars. Even moderately successful artists or those with some local recognition can produce art whose value will grow in years to come.

Now, keep in mind that, in modern day and age, we have the tools to browse the collective knowledge of all mankind. This means that you can get to see more pieces of art than any art dealer in history. This creates a paradox of choice, and if you’re not knowledgeable on a subject matter, you’ll need an appraiser. The services of this expert won’t come cheap.

Also, don’t expect to buy a painting at a garage sale and sell it for millions of dollars. Outside of fiction, it doesn’t work this way. You need to find something moderately expensive that will become very expensive. In other words, you need a solid budget.

- Collectibles

This one is a continuation of the previous segment since art can definitely be counted among collectibles. Still, there are other types of assets you should consider, as well. For instance, you could look for rare coins. Coins with historical significance can be incredibly expensive. Other than this, numismatics can be a fun hobby.

Vintage wines and spirits are another interesting investment opportunity. As you know, quality wines gain value with age, which means that this is a potentially amazing position investment. Again, like with the art, you need to make a quality investment first.

- Designer bags

Scarcity is the best antidote to depreciation. You see, the majority of designer brands manufacture bags in limited series. This is why these bags don’t lose value over time. If anything, their value might grow over time.

According to some, these bags may be a better investment choice than rare cars or even artwork. Nonetheless, it has to be the right brand, which means going for Hermes, Chanel, Goyard, or Louis Vuitton. However, it also means that you’ll have to set aside a sizable budget. Unlike with stocks and cryptocurrencies, you can’t buy fractions.

With more investment types, your portfolio becomes ever more secure

Diversifying your investments is important; however, this doesn’t mean just keeping your money in multiple cryptocurrencies or multiple stocks; it means scattering investments across many different asset types. With so many potential assets to choose from, picking the right set to diversify your portfolio shouldn’t be too hard.