With the June 14th primaries just months ahead, inflation fears are the top concern in the U.S. 7th Congressional District.

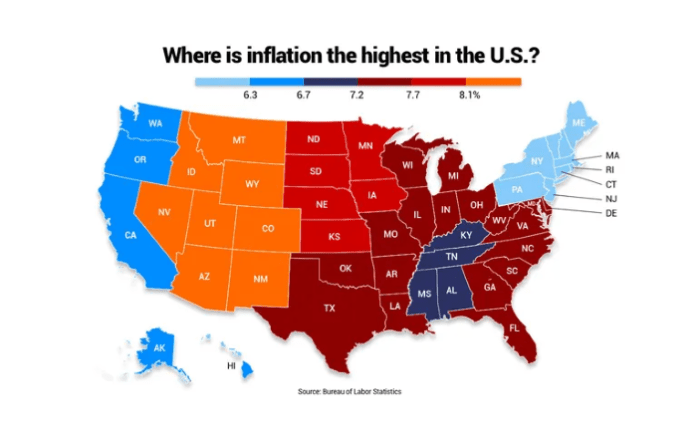

As Fox Business reviewed the data from late December, it reports: States that are experiencing red-hot inflation are North Dakota, South Dakota, Nebraska, Kansas, Minnesota and Iowa, with prices up 7.7% from last year. It was trailed by a 7.5% increase in Maryland, West Virginia, North Carolina, South Carolina, Georgia, Florida, Texas, Oklahoma, Louisiana, Arkansas, Missouri, Illinois, Wisconsin, Indiana, Michigan and Ohio.

In Horry County, the inflation calculator puts the rate currently at around 9.5%.

GALLIVANTS FERRY FARMER SOUNDS OFF

Local Congressional Candidates sound off as well.

We interviewed candidate Jeanette Spurlock of Conway, S.C. She said she believed everyday citizens of U.S. District 7 were not being represented by incumbent Congressman Tom Rice.

Ken Richardson is the leading front runner among non-Myrtle Beach Area Chamber of Commerce associated candidates. Said Ken Richardson, “Since February 3, 2021, when I announced, gas prices have climbed $1.25 per gallon. At this rate, gas will be $4 per gallon by the time the June 14th primaries are held.“

Added Richardson, “If I am elected, the 1st thing we will address in Washington is inflation. The key is to make America energy independent once again. That includes returning to policies that allow fracking and opening up the keystone pipeline right away.”

Ken Richardson said, “My family has lived in this district for generations. I have never seen the grocery store shelves as empty as they are right now.”

FEDERAL RESERVE TO REACT IN MARCH

Central banks have started reacting to inflation. In February, the Bank of England raised its base rate for the second time in two months, and the U.S. Federal Reserve is expected to do the same at its meeting in March. (Interestingly, so has the Bank of Russia—even the threat of war can’t break the dominant contemporary central banking consensus.)