Home Insurance premiums rise 100% to 700% in 2023/24

The North Myrtle Beach Chamber of Commerce held an insurance forum this past Tuesday night. Just over 1,000 concerned residents showed up. By show of hands in the video above, practically every resident witnessed insurance increases of from 100% to 700% with a typical 48 hours to 5 days notice of these increases before payment was due.

The event was chaired by S.C. Representative William Bailey.

Bailey said he was shocked at his most recent home insurance rate increase. He is now fully involved in helping solve the problem. Other state delegation members who attended were Rep. Case Brittain of Myrtle Beach and Representative Tim McGinnis of Carolina Forest up to Barefoot Resort. The North Myrtle Beach Chamber and Myrtle Beach Chamber C.E.O.’s were also in attendance along with key North Myrtle Beach City Council members.

After the meeting ended, Leadership in the Republican Caucus reached out to MyrtleBeachSC News stating they will add this as a top priority to the agenda in the 2024 legislative session which begins on January 2nd.

Common Concerns

The video (top of article) gives insight to what over 300,000 Horry County residents are currently facing.

One resident identifying herself as Sam, who lives in Edgewater at Barefoot Resort said, “Our premiums have gone up 700%. We have been extorted to take flood insurance. We don’t need it…. What are our elected officials planning on doing?”

Said Representative Bailey, “We have 124 members in the S.C. House of Representatives. When we come up with ideas, we get them in these kind of [town hall] meetings. And we establish a game plan. When we get our appropriate game plan we go and try to sell it to 124 members, so we can get a majority of those votes to get legislation [passed]… We are going to do it [town halls] up and down the coast and we are going to build that coalition.”

Once again, just from the one Town Hall meeting, House Speaker Murrell Smith is ready to address the problem this coming legislative session. The town hall was a major success for legislative change and hopefully tort reform.

Said Larry Adams of the Palm Lakes Garden Homes HOA, “To go a 100% increase in one year, what are we getting? What are you going to do when they [homeowners] walk out and we get foreclosures? This is going to be a ghost town. Right now, because of this, if I wanted to try to sell my property, I couldn’t do it. Who in their right mind one come in and pay a mortgage, and they are paying an assessment and an HOA fee that’s more than their mortgage.”

Denise, the President of the Waipani Homeowners Association said, “We budgeted 40% more at Waipani for our insurance this year. At the end of the day our costs ended up being 4 times what we budgeted. In the months leading up to our renewal we were told that we might not be able to get insurance. And if we did, we would have to go through the South Carolina Wind and Hail underwriters group. And that would be 7 to 8 times what we budgeted. As we were we maybe couldn’t get insured, when we started talking to other insurance agents, thinking this can’t be right, these other agents we talked to were unable to even look for other options for us. When you work with an agent, they actually lock your house. So any partners they work with, any underwriters, no one else as long as you have them as your agent of record, can search on your behalf.”

UNDERWRITERS – What is Reinsurance?

Reinsurance is a practice in which insurance companies transfer a portion of their risk to other insurance companies. It is a way for insurance companies, known as the ceding companies, to protect themselves against large and catastrophic losses by spreading the risk across multiple insurers.

When an insurance company sells policies to individuals or businesses, it assumes the financial responsibility for any claims that may arise from those policies. However, if there is a large number of claims or a single catastrophic event that results in substantial losses, the insurance company may not have enough capital to cover all the claims. Reinsurance helps mitigate this risk by allowing the insurance company to transfer a portion of the potential liability to another insurer, called the reinsurer.

The reinsurer agrees to accept a portion of the ceding company’s premiums in exchange for assuming a corresponding portion of the risk. This allows the ceding company to reduce its exposure to large losses, maintain its financial stability, and continue providing coverage to policyholders.

Reinsurance can be structured in various ways, such as proportional reinsurance or non-proportional reinsurance. In proportional reinsurance, the reinsurer shares a proportionate amount of both the premiums and losses with the ceding company. In non-proportional reinsurance, the reinsurer only covers losses exceeding a certain threshold, often referred to as the “retention” or “deductible.”

Overall, reinsurance plays a crucial role in the insurance industry by enabling insurers to manage risk effectively and maintain financial stability in the face of unexpected or significant events.

Reinsurance clearly is not the entire answer as home insurance premiums rise 100% to 700% despite the programs in place. It is a huge help, however.

Three key problems

Horry County has three underlying issues that are causing insurance companies to either go bankrupt, or leave the state.

- Horry County Council has approved building in flood zones against the best interests of locals. They did this just recently by lowering the elevation standards from 3 boards to 2 boards elevation. They approve these risky ventures for their friends in the development business. Real Estate development is a $38 billion annual income industry. It’s the largest industry in Horry County.

- We live on the coast and we are a threat for a hurricane every August through October. This is a risk many insurance underwriters are unwilling to accept. Insurers in the state have been paying out $3 for every $1 they collect, explained Michael B. Wise State of South Carolina Director of Insurance.

- Too many legislative lawyers in S.C. that work for the best interests of the trial lawyers.

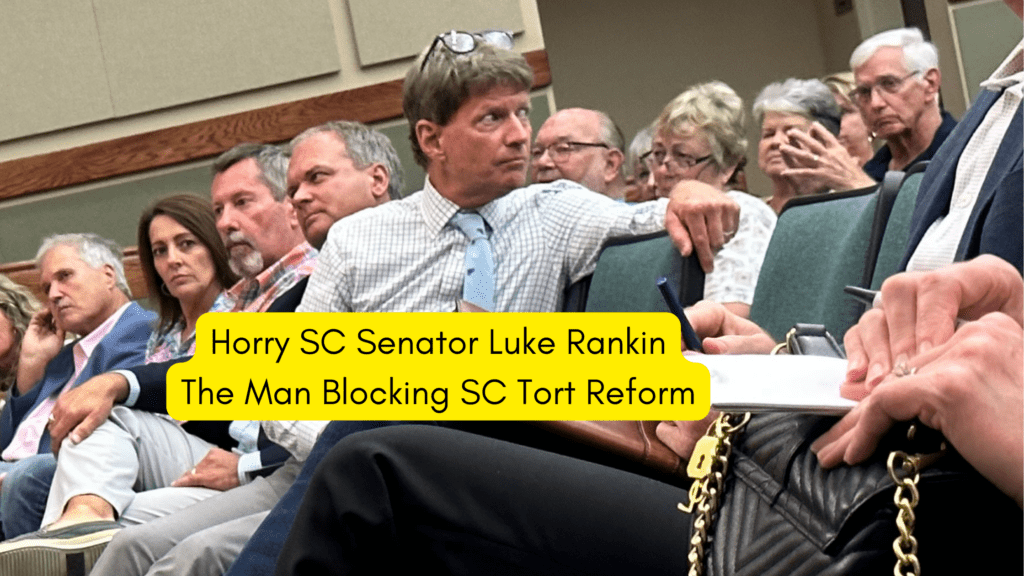

A Key Example Senator Luke Rankin

Representative Bailey spoke honestly when he claimed the majority of 124 House members must agree on legislation that will bring more insurance carriers into the state.

What he didn’t mention is that this very legislation can be good for residents, good for the insurance industry, but not good for trial lawyers.

Rankin sits on and manages key subcommittees in the S.C. Senate. Once a bill passes the S.C. House, it goes to the S.C. Senate. Rankin can literally kill a great bill for locals by allowing it to die in a senate subcommittee.

The bill never makes the senate or house floor. The trial lawyers dance all they way to the bank as home insurance premiums rise 100% to 700% and insurance providers continue to flee the state.

The South Carolina OFFICE OF CONSUMERS AFFAIRS met with us during the town hall. They provided a phone number residents can reach them at: 803-737-6180. They also provided an email address at [email protected].

As home insurance premiums rise 100% to 700%, residents can also find the State of South Carolina Department of Insurance at Capitol Center, 1201 Main Street, Suite 1000, Columbia, S.C. 29201