Records produced by the City of Myrtle Beach provide a clear indication of just who is funding the city’s $200 million annual budget. The records also show that non voting condo rental owners carry the responsibilities of funding the city, along with commercial property owners.

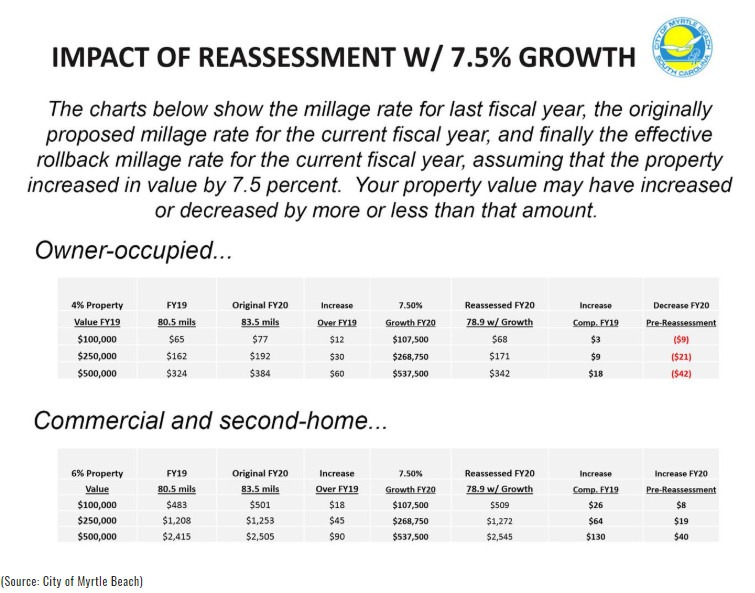

In the chart above, please note that a local, voting, city resident homeowner, owning an average home valued at $250,000 pays $162 in taxes.

However, an out of state investor who owns a condo, managed by one of the big 5 property management firms, is charged $1,208 for that same valued real estate. Out of state condo owners are being charged 7.5 times the tax rate of local residents for the very same properties.

NON VOTERS CARRY CITY’S TAX BURDEN

There are approximately 22,000 condos located inside the city limits of Myrtle Beach. These “out of state” investors carry the tax burden of Myrtle Beach in various ways. None can vote.

TDF -Tourism Development Fee

The TDF, tourist tax, is a local one percent tax charging tourists (and locals) one percent of the total sale on products purchased inside the city limits. A large portion, of $24 million collected annually in TDF taxes, are paid for by guests who stay in condos rented by property managers acting on behalf of these condo owners. These tourists can’t vote either.

BUSINESS LICENSE TAX?

Whether these condo rental investors believe they own a city business or not is inconsequential. The city sees these investors as business owners and sends out an annual $250 city business license fee to each. Tax revenues for the city amount to more than $5 million.

Pay the fee, or the property manager will not rent your condo until it is paid.

The city of Myrtle Beach could never make its $200 million annual budget on $162 in taxes, per property, charged to voting locals.

WE FOUGHT A WAR OVER THIS

The taxation method leveraged by the City of Myrtle Beach allows them to mistreat downtown merchants and bully locals. Several merchants are asking to be de-annexed from the city.

Why? Because the city’s tax revenues are not dependent on these merchant groups.

The city is cleverly, but unethically, choosing to fund city government largely on the backs of “non voting” condo owners, tourists, and merchants.

Taxation without representation is the act of being taxed by an authority without the benefit of having elected representatives. The term became part of an anti-British slogan when the original 13 American colonies aimed to revolt against the British Empire.